Investing can be a mental minefield. Our brains, wired with an array of cognitive biases, often trip us up, making the path to financial success more challenging. In […]

Interest Rates and Their Influence on Portfolio Rebalancing

Navigating the ebb and flow of interest rates is crucial for savvy investors aiming to maintain a balanced portfolio. As rates climb or tumble, the financial landscape shifts, […]

Diversification Strategies for Angel Investors

Angel investors, often the financial backbone for startups, face a unique conundrum. Balancing high-risk opportunities with the potential for substantial rewards requires a strategic approach to investment. Diversification […]

Gold Investments in Times of Geopolitical Uncertainty

In times of global unrest, savvy investors often turn to the enduring security of gold. This precious metal has historically held its ground amidst political upheaval and economic […]

Aligning International Investments with ESG Factors

As investors cast their nets across the globe, aligning with Environmental, Social, and Governance (ESG) factors isn’t just nice-to-have; it’s a must. It’s the compass that guides capital […]

Generating Income with International Dividend Stocks

Embarking on a journey to bolster your income? Consider this: tapping into the global market through international dividend stocks. It’s like unlocking a treasure chest of opportunities that […]

The Pros and Cons of Real Estate Investments Abroad

Dipping your toes into the world of international property investment? You’re not alone. Many are lured by the potential high returns and the thrill of diversifying their portfolio […]

Achieving Portfolio Diversification with Global Investments

In a world where market fluctuations are as certain as the sunrise, savvy investors turn their gaze to global investment strategies. Achieving portfolio diversification isn’t just about ticking […]

ETFs vs Mutual Funds: Tax Considerations

When it comes to growing your wealth, choosing the right investment vehicle is crucial. ETFs (Exchange-Traded Funds) and mutual funds often feature in this high-stakes decision. Both offer […]

How Do Treasury Bonds Work and Are They a Safe Investment?

Treasury bonds, also known as T-bonds, are long-term authorities debt securities issued by the Treasury Department of the United States with a maturity interval usually starting from 20 […]

How Does Real Estate Crowdfunding Work?

In an period marked by digital innovation and connectivity, actual property investing has transcended past the normal obstacles, embracing the ability of collective collaboration by way of an […]

What Does The Information Demonstrate About Alex’s Investments

When talking about financial investment methods and results, it’s essential to wield a fine-toothed analytical comb through the information on hand. In the case of Alex, an enthusiast […]

ETFs vs Mutual Funds in Retirement Planning

When it comes to securing your golden years, choosing the right investment vehicle is crucial. You’ve probably heard of ETFs (Exchange-Traded Funds) and mutual funds, but knowing which […]

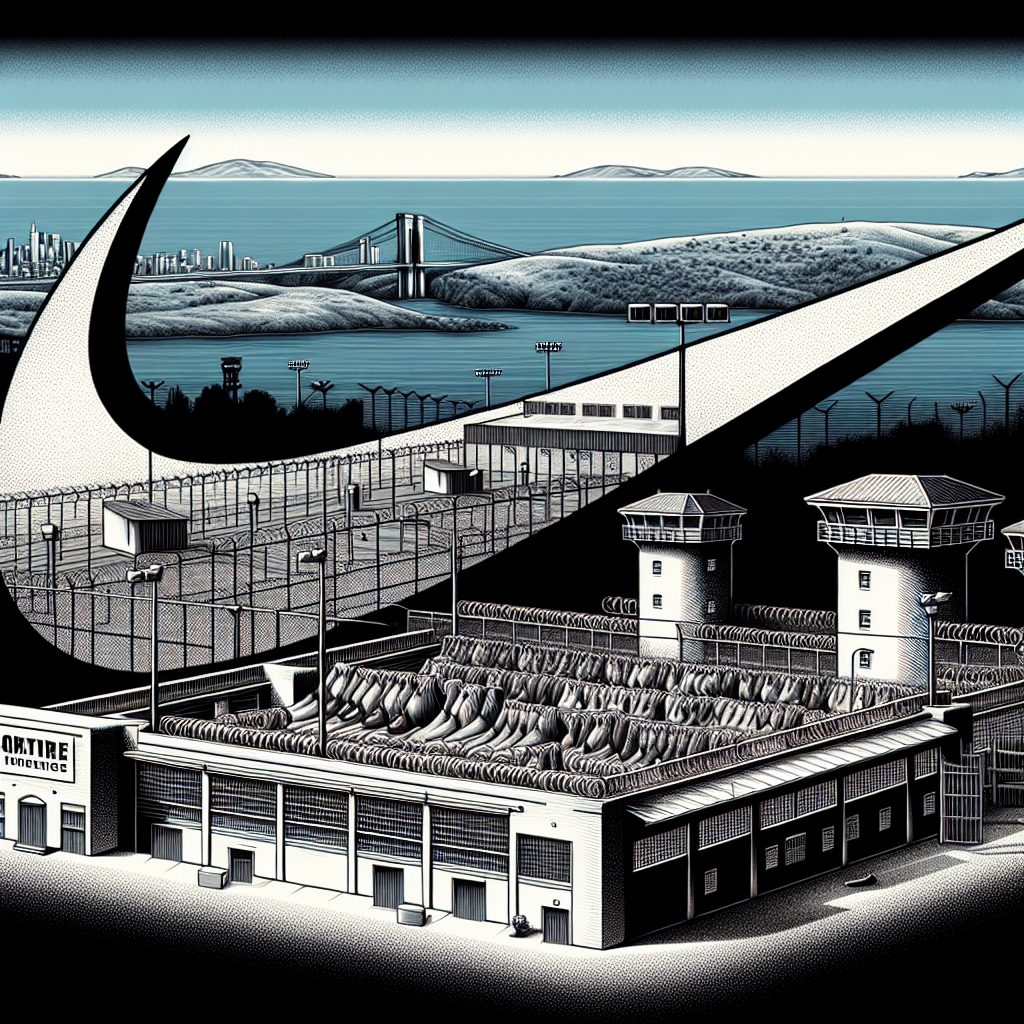

Does Nike Invest In Private Prisons

In current years, the crossway of big corporations and the criminal justice system has actually triggered questionable conversations, especially concentrating on the participation of private jails. These organizations […]

Who Owns Lakoma Island Investments Llc

In the complex tapestry of property financial investment, LLCs (Limited Liability Companies) stand apart as a popular structure for home ownership due to their capability to restrict individual […]

Tax Implications: ETFs vs Mutual Funds

Navigating the labyrinth of investment tax implications can be as daunting as it is crucial. When you’re weighing the pros and cons between Exchange-Traded Funds (ETFs) and Mutual […]

How Can Investors Measure the Social Impact of Their Investments?

In an period the place acutely aware capitalism is gaining unprecedented momentum, the time period ‘social impression investing‘ has emerged as a clarion name for buyers aiming to […]

What Impact Does Market Sentiment Have on Investments?

Market sentiment, sometimes called “investor sentiment,” is the overall prevailing perspective of buyers as to anticipated worth developments in a market. This psychological phenomenon is a composite of […]

Cost Analysis: ETFs vs Mutual Funds

Navigating the investment landscape, you’ve likely encountered the debate of ETFs versus mutual funds. Both stand as popular vehicles for diversifying portfolios, but the cost implications of choosing […]

ETFs vs Mutual Funds: An Introductory Guide

In the financial jungle, choosing the right investment vehicle can make all the difference. ETFs (Exchange-Traded Funds) and mutual funds often stand out as popular choices, but sifting […]