In the ever-evolving world of finance, diversification stands as a cornerstone strategy for those eyeing long-term growth. It’s like not putting all your eggs in one basket—a mix […]

Portfolio Diversification Strategies for Recession Times

In uncertain economic times, safeguarding your investments becomes a top priority. The savvy investor knows that the key to weathering financial storms lies in a well-diversified portfolio. This […]

Diversification Strategies for Angel Investors

Angel investors, often the financial backbone for startups, face a unique conundrum. Balancing high-risk opportunities with the potential for substantial rewards requires a strategic approach to investment. Diversification […]

Enhancing Portfolio Diversification with Gold

Diversifying your investment portfolio is like setting sail on the vast financial seas; you need a sturdy vessel to weather market storms. Gold, that timeless beacon of stability, […]

Hybrid Approaches: Combining Passive and Active for Diversification

In the ever-evolving world of investment, savvy players are always on the lookout for the smartest strategies to grow their portfolio. Enter the hybrid approach—an ingenious blend of […]

Diversification Strategies in Passive and Active Portfolios

Navigating the financial landscape requires a savvy blend of strategies, especially when it comes to fortifying your investments against market volatility. Diversification stands as the cornerstone of managing […]

Expanding Beyond Home Bias in Your Investment Portfolio

Diversifying your investment portfolio is like opening a door to a world of new opportunities. Picture this: you’re not just bound to the familiar stocks and bonds of […]

Achieving Portfolio Diversification with Global Investments

In a world where market fluctuations are as certain as the sunrise, savvy investors turn their gaze to global investment strategies. Achieving portfolio diversification isn’t just about ticking […]

The Role of ESG in Achieving Portfolio Diversification

In the dynamic world of investing, ESG criteria—encompassing environmental, social, and governance factors—are reshaping how we evaluate portfolio health. Savvy investors now look beyond traditional financial metrics to […]

How Does Diversification Work in Cryptocurrency Investing?

In the unstable world of cryptocurrency investing, diversification is a method akin to not placing all of your digital eggs in one basket. By its very definition, diversification […]

Achieving Diversification with ETFs and Mutual Funds

In the investment world, diversification is key to managing risk. But how do you spread your bets without spreading yourself too thin? Enter ETFs and mutual funds—vehicles that […]

What Is Investment Holding

Investment holding is not your ordinary service endeavor; it is an advanced business whose main function is to own shares in other business as a way to manage […]

What are index funds?

Index funds have actually gradually increased as the financial investment lorry of option for those searching for a wise, passive technique to growing their wealth. Essentially, an index […]

What is an investment portfolio and how do I build one?

An investment portfolio is a collection of possessions that can consist of stocks, bonds, money, realty, and other monetary investments, which are owned by an private or an […]

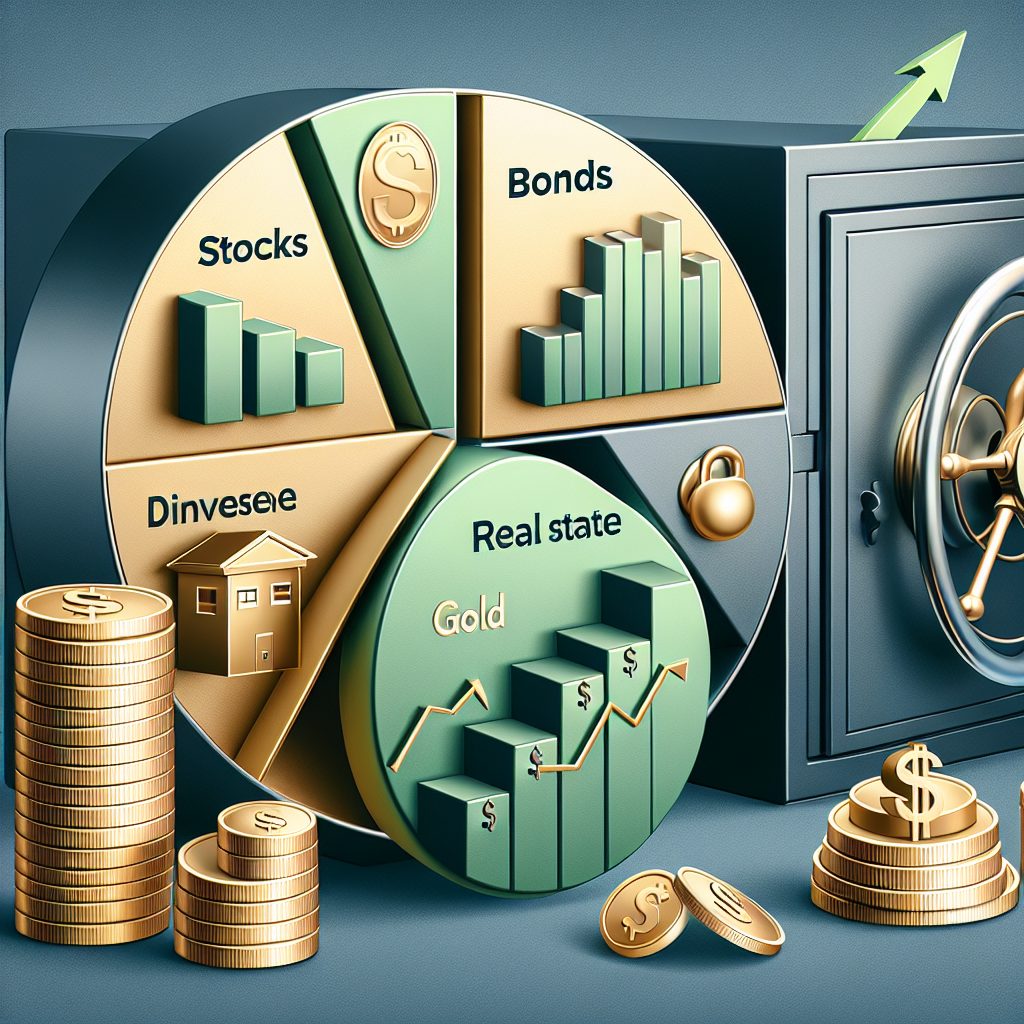

Bonds vs Stocks: Diversifying Your Portfolio

When it comes to securing your financial future, putting all your eggs in one basket simply won’t cut it. That’s where diversifying your portfolio becomes essential. You’ve likely […]

How Do I Choose the Right ETF for My Portfolio?

Exchange-Traded Funds (ETFs) are transforming the financial investment landscape, using a mix of diversity similar to shared funds with the ease of trading looking like stocks. Unlike standard […]

How Can I Start Investing in Alternative Assets?

Alternative possessions are monetary investments that fall outside the standard classifications of stocks, bonds, and money. They include a varied variety of possessions such as realty, products, hedge […]

What are the benefits of diversification in an investment portfolio?

In the world of investing, diversification belongs to not putting all your eggs in one basket; it’s the technique of dispersing financial investments throughout different monetary instruments, markets, […]

What are the best ways to manage investment risk?

Investment threat is the capacity for monetary loss intrinsic in any investment choice. Pivotal to comprehending this principle is the awareness that the nature of investment is fundamentally […]

What are the benefits of international investing?

International investing describes the practice of assigning funds in financial investment chances outdoors of a financier’s home nation. By taking part in portfolios that cover throughout international markets, […]