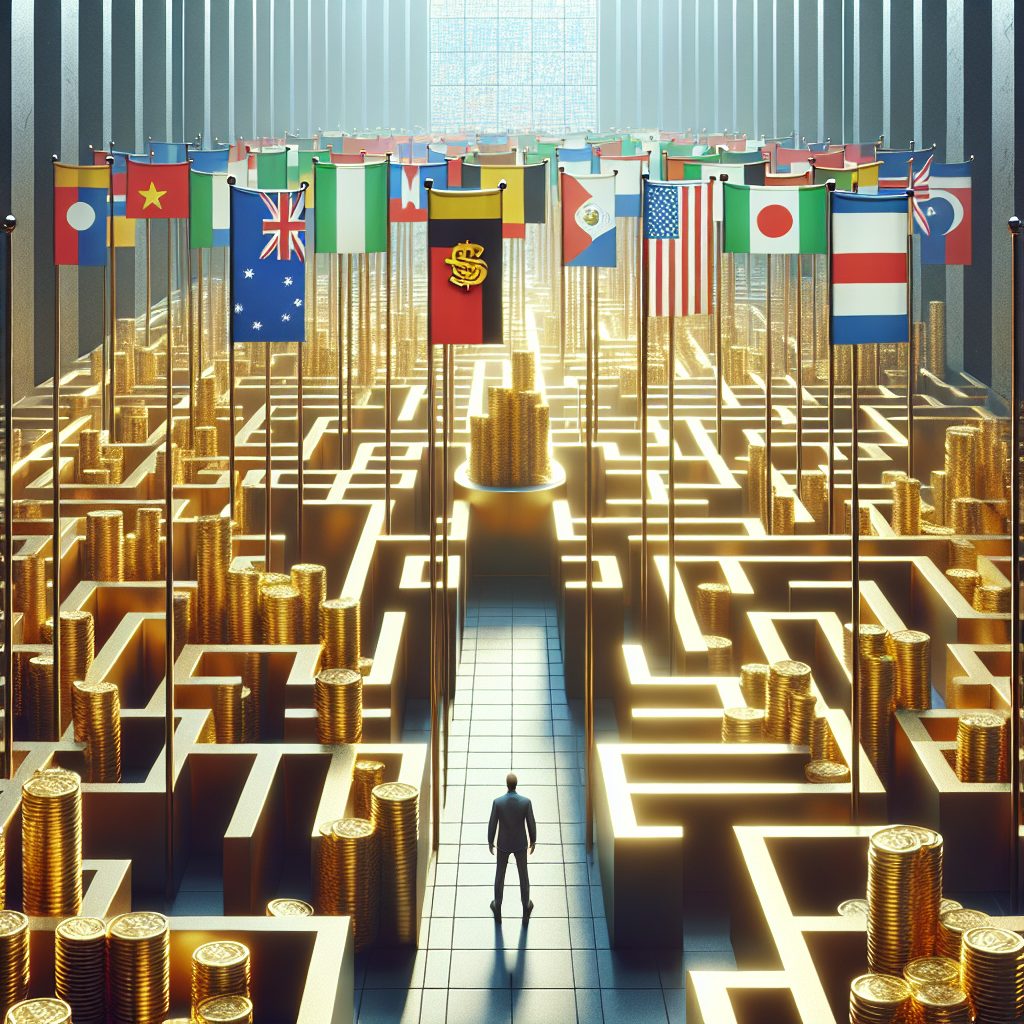

When global businesses flourish, the challenge of moving earnings back home surfaces. Navigating the repatriation of profits from international markets is no small feat. It’s a dance with compliance, tax implications, and financial strategy that requires finesse and know-how. Companies looking to bring their hard-earned cash back to domestic soil must tread carefully through a complex web of regulations.

In this exploration, we’ll delve into the maze of cross-border financial flows, offering insights on how to repatriate funds efficiently and legally. You’ll learn about optimizing currency conversion, leveraging tax treaties, and sidestepping common pitfalls. Whether you’re a seasoned CFO or an entrepreneur expanding abroad, there’s wisdom in these words for anyone aiming to secure their overseas profits without hitting snags. Let’s unlock the secrets to successful profit repatriation together, keeping it straightforward and jargon-free so you can get down to business.

Important Highlights

1. When repatriating profits from international markets, it is crucial to understand the local and home country tax regulations. Companies must navigate double taxation agreements to ensure they are not paying more than necessary. Utilizing strategies such as transfer pricing can be effective in managing tax liabilities; however, these strategies must adhere to global standards set by organizations like the OECD to avoid legal issues.

2. Companies should establish a robust financial infrastructure that supports efficient profit repatriation. This includes selecting the right banking partners and ensuring financial processes align with both host and home country requirements. Currency exchange rates also play a significant role, so timing and currency risk management tools can be beneficial in maximizing returns.

3. Legal structures significantly influence repatriation strategies. Firms need to choose between setting up a subsidiary, branch, or partnership carefully, as each option has different implications for profit extraction. For instance, subsidiaries often allow for greater flexibility in profit distribution but may be subject to higher scrutiny from local tax authorities.

4. Political risk is an unavoidable aspect of operating across borders. Companies have to stay informed about potential changes in foreign government policies that could affect profit repatriation, such as capital controls or sudden shifts in economic policy. Engaging with local advisors and staying abreast of political developments can help businesses anticipate and mitigate these risks.

5. Lastly, companies must consider the impact of profit repatriation on their overall global strategy and stakeholder relationships. Repatriating funds might signal a lack of reinvestment in the local market, which could affect local operations and partnerships negatively. Balancing reinvestment with shareholder expectations requires strategic planning and clear communication with all parties involved.

Understanding Repatriation Regulations

Businesses looking to repatriate earnings must first comprehend the legal framework governing international fund transfers. Each country has its own set of regulations that dictate how profits can be moved across borders. These rules often involve tax obligations, such as withholding taxes or double taxation agreements, which can impact the net amount repatriated. Familiarize yourself with both the local laws in the foreign market and those of the home country. For instance, the United States Tax Treaties can offer guidance on how American companies should proceed.

Currency Conversion and Exchange Rates

Exchange rates fluctuate regularly, affecting the value of your repatriated profits. Execute transactions when rates are favorable to maximize returns. Employ hedging strategies, like forward contracts or options, to mitigate risks associated with currency volatility. Understanding and monitoring forex trends is essential for timing these conversions effectively.

Optimizing Tax Efficiency

Tax efficiency is crucial for maximizing repatriated profits. Explore avenues like tax credits and deductions available for businesses operating internationally. Transfer pricing, if managed within legal bounds, can also play a significant role in how much profit is taxable in each jurisdiction. Engage with tax professionals specialized in international business to navigate these complex scenarios.

Balancing Reinvestment with Profit Repatriation

Determine an optimal balance between reinvesting earnings into the foreign market and repatriating profits. Reinvesting can promote growth and potentially lead to greater long-term returns, but it’s important not to neglect short-term financial needs at the parent company level.

Risk Management Strategies

Incorporate risk management into your profit repatriation plan. Political instability, economic downturns, or changes in regulation can hinder the ability to move money freely. Establishing a diversified portfolio of investments across various markets can help buffer against such risks.

Involvement of Financial Institutions

Select credible financial institutions with a strong international presence to facilitate cross-border transactions. They provide valuable services such as multi-currency accounts and global payment networks which are imperative for efficient fund transfer.

Cash Pooling Techniques

Cash pooling allows companies with multiple subsidiaries to manage liquidity more effectively by balancing accounts receivable and payable within the group. This technique optimizes cash resources and can simplify the process of repatriating funds.

Audit Trails and Documentation

Maintain meticulous records of all international transactions to ensure compliance with regulatory requirements and facilitate smooth audits. Proper documentation supports legitimacy and transparency in profit repatriation activities.

Leveraging Technology for Efficient Processes

Invest in robust financial software that aids in tracking funds across borders, managing exchange rates, and providing real-time analytics about cash flow positions.

Evaluating Market Exit Strategies

If exiting a market becomes necessary, have an exit strategy that minimizes losses and efficiently extracts remaining profits while adhering to local dissolution regulations.

Negotiating With Local Governments

Negotiations may sometimes be required with local governments especially concerning large-scale profit repatriation events which could significantly impact local economies.

- 1. Ensure understanding of local regulations before initiating profit repatriation.

- 2. Monitor exchange rates closely and employ hedging strategies where appropriate.

- 3. Consult with tax professionals to optimize tax liabilities internationally.

- 4. Strike a balance between reinvestment in foreign markets and funds repatriation.

- 5. Develop comprehensive risk management strategies tailored to international operations.

- 6. Choose financial institutions with expertise in handling international transactions efficiently.

- 7. Utilize cash pooling methods among subsidiaries for better liquidity management.

- 8. Keep detailed records of all cross-border money movements for auditing purposes.

- 9.Incorporate technology solutions “font-weight: bold;”>for real-time financial oversight across jurisdictions.

- . Plan market exit strategies ahead of time considering potential implications on profit retrieval.

- >11.Negotiate tactically “font-weight: bold;”font-weight: bold;”>with local authorities over large-scale repatriations when needed.

.

Frequently Asked Questions

What does repatriating profits mean?

Repatriating profits refers to the process of transferring money earned from a company’s foreign operations back to its home country. This often involves currency exchange and navigating tax laws.

Are there taxes on repatriated earnings?

Yes, many countries tax repatriated earnings. The specific rates and regulations depend on local tax laws and international treaties. It’s crucial to consult with a tax professional for guidance.

How can I minimize taxes on repatriated funds?

To reduce taxes, consider strategies like tax credits, deductions, or using foreign entities in lower-tax jurisdictions. Always ensure these methods comply with all legal requirements.

What are the challenges of profit repatriation?

The main challenges include fluctuating exchange rates, complex tax regulations, and potential political risks that can impact the flow of funds across borders.

Can exchange rates affect the amount repatriated?

Absolutely. Exchange rate volatility can increase or decrease the value of repatriated profits. Timing and currency management strategies are important to optimize returns.

Should I seek professional advice for profit repatriation?

Definitely. Navigating the nuances of international tax law and financial regulation is complex, so professional advice is strongly recommended for effective planning.

Are there restrictions on how much profit can be sent home?

In some cases, yes. Countries may have controls that limit capital movement to protect their economies. It’s essential to verify any restrictions before initiating transfers.

Is it better to reinvest abroad or repatriate profits?

This decision depends on your business goals, growth opportunities, and the fiscal implications in both the host and home countries. Analyze both scenarios thoroughly.

What are the considerations for repatriating profits from international mergers and acquisitions?

When engaging in crossborder investing strategies through international mergers and acquisitions, it is crucial to consider the best approach for repatriating profits. Factors such as tax laws, foreign exchange rates, and political stability can significantly impact the repatriation process and ultimately affect the success of the investment.

How do double taxation agreements affect profit repatriation?

Such agreements aim to prevent income from being taxed twice. They can provide relief through exemptions or credits that reduce the overall tax burden on repatriated profits.

What role does compliance play in profit repatriation?

Compliance with all relevant laws and reporting requirements is critical to avoid penalties and ensure a smooth process when moving funds across borders.

Closing Insights on Repatriating Profits

Navigating the complexities of profit repatriation demands careful planning and attention to detail. While there are hurdles such as taxes, legal barriers, and market fluctuations, there are also strategic approaches that can streamline this process. By staying informed about international finance norms and leveraging expert advice, businesses can effectively manage their global earnings and support their financial objectives.

In conclusion, understanding the intricacies of international markets is key to successfully repatriating profits while mitigating risks and maximizing returns. As global commerce continues to evolve, so too must our strategies for managing overseas profits with finesse and acumen.