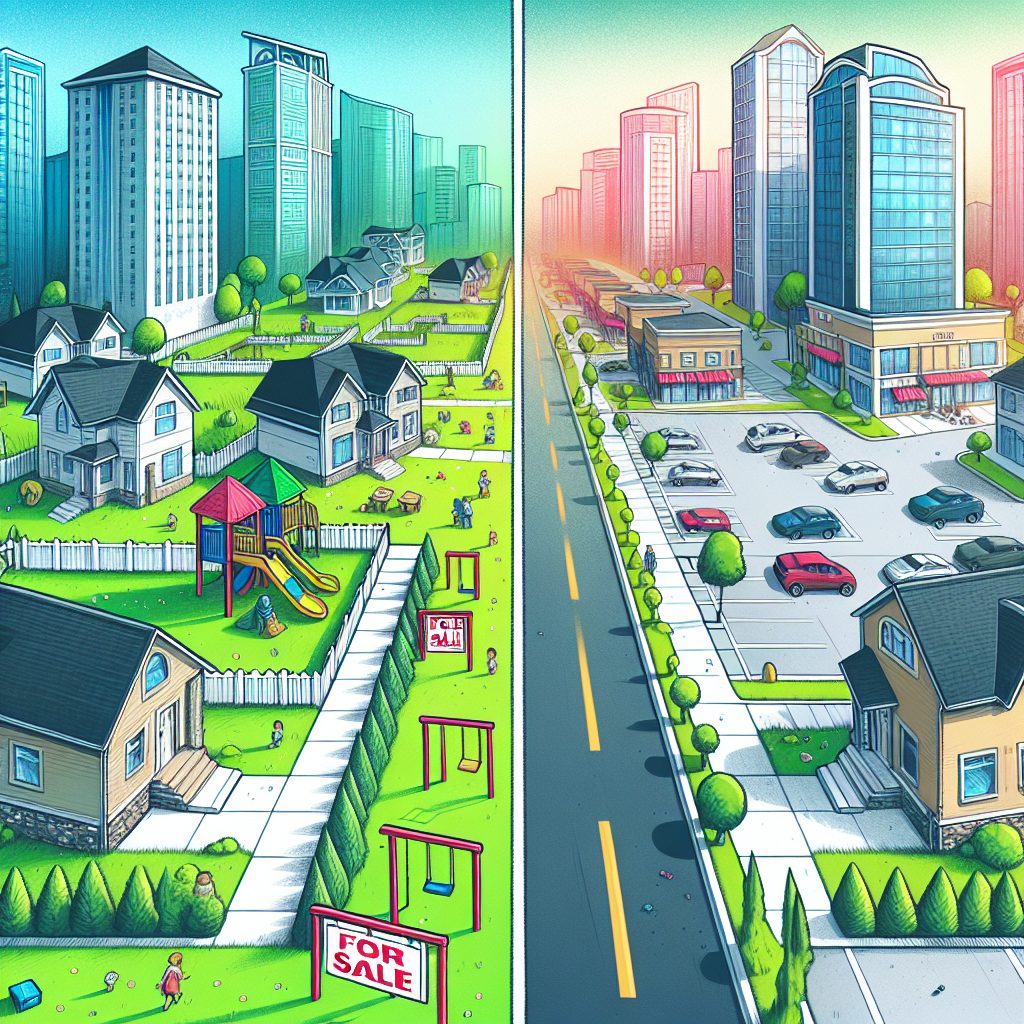

Commercial actual property (CRE) and residential actual property investments stand as pillars of the huge property funding panorama, but they differ essentially when it comes to operations, financing, and scale. CRE refers to properties used completely for business-related functions, encompassing every thing from workplace buildings and retail areas to inns and industrial warehouses, whereas residential actual property is comprised of housing items for people or households, ranging from single-family houses to multi-unit flats. Each sector has distinct market dynamics; business actual property is pushed by enterprise wants and financial indicators, whereas residential investments are extra intently tied to shopper conduct and native inhabitants tendencies. The distinctive options, equivalent to longer lease phrases and the complexity of business property transactions, make CRE a distinct enjoying subject, with probably larger preliminary investments and specialised data necessities in comparison with the sometimes extra accessible residential market.

As the curtains draw again additional on the intricacies of those two actual property worlds, key takeaways start to emerge, illuminating the divergent paths an investor could tread inside every sector. The subsequent discussions will delve into the variance in money circulation patterns, the importance of location in figuring out the worth of CRE versus residential properties, and the way financial shifts can disproportionately have an effect on one sort of funding over the opposite. Tenants, lease buildings, and profitability fashions in business investments distinction sharply with these present in residential actual property, with every carrying its personal threat and reward profile. Stay tuned as we unpack these variations in better element, shedding mild on how buyers can navigate these two markets and align their methods with their monetary objectives and threat tolerance ranges.

Key Takeaways

1. Investment Scale and Capital Requirements: Commercial actual property investing sometimes includes a bigger scale of property and consequently requires a better preliminary capital funding in comparison with residential actual property. Investors in business properties are sometimes coping with multi-unit workplace buildings, retail areas, or industrial complexes, which symbolize a considerable monetary dedication and infrequently necessitate pooling sources by way of partnerships or funding teams.

2. Lease Structure Complexity: The lease buildings in business actual property are usually extra complicated and longer in period. Unlike residential leases which could final for a 12 months, business leases can lengthen for five to 10 years or extra. This can present a extra secure and predictable revenue stream for buyers, however it additionally signifies that phrases like lease escalations, upkeep clauses, and different contractual components are extra intricate, requiring a extra thorough understanding of business actual property regulation.

3. Professional Tenant Relationships: Tenant relationships in business actual property are sometimes extra skilled and formal than in residential actual property, since tenants are sometimes companies quite than people. This can lead to fewer administration points and decrease turnover charges, as companies often prioritize sustaining a constant location. However, it additionally signifies that tenant choice is vital, because the success of the tenant’s enterprise instantly impacts the property’s profitability.

4. Distinct Valuation Methods: The valuation of business properties is strongly influenced by the revenue they generate, which is assessed by way of the capitalization price (cap price) or the revenue method to worth. In distinction, residential properties are regularly valued based mostly on comparable gross sales within the space (the gross sales comparability method). As a consequence, business buyers should be adept at analyzing monetary statements and understanding market rents and bills to make knowledgeable choices.

5. Risk and Reward Profile: Commercial actual property investing tends to contain a distinct risk-reward profile in comparison with residential actual property. Due to the longer lease phrases and reliance on the financial viability of tenant companies, there’s the potential for larger returns, but in addition elevated threat if a tenant goes out of enterprise or the business market experiences a downturn. Additionally, business property investments are sometimes much less influenced by modifications within the housing market, which might diversify an investor’s portfolio.

What Are the Key Differences Between Investing in Commercial vs. Residential Real Estate?

Types of Properties Involved

Commercial and residential actual property investments contain distinctly several types of properties. Residential actual property sometimes contains single-family houses, condominiums, townhouses, duplexes, and small residence buildings with one to 4 items. On the opposite hand, business actual property encompasses bigger residence complexes with 5 or extra items, workplace buildings, retail areas, warehouses, industrial buildings, and special-purpose buildings like inns and healthcare amenities.

Lease Terms and Tenant Relations

Lease contracts in business actual property are typically for much longer than in residential, typically ranging from 5 to 10 years with choices to resume. Residential leases sometimes final for one 12 months. This impacts money circulation stability and tenant turnover charges, with business properties usually providing extra long-term stability. With longer leases, the frequency of discovering new tenants is lowered. However, business lease agreements are additionally extra complicated, typically requiring an intensive understanding of business tenant legal guidelines, triple web leases, and customary space upkeep charges.

Investment Performance Metrics

Investors consider business and residential properties in a different way. Residential property values are sometimes influenced by comparable gross sales within the neighborhood. In distinction, business properties are valued based mostly on their revenue potential, utilizing metrics like capitalization price (cap price), web working revenue (NOI), and money on money return. Understanding and calculating these metrics is essential for evaluating completely different business funding alternatives.

Financing and Down Payment Requirements

Financing phrases for business actual property are sometimes stricter than residential. Lenders typically require larger down funds, generally 30% or extra of the property’s buy worth. Loan phrases can also be shorter, and rates of interest may be larger in comparison with residential loans. Investors trying to finance business properties ought to be ready for a rigorous mortgage approval course of that evaluates each private creditworthiness and the monetary efficiency of the property.

Professional Networking and Expertise

Successfully investing in business actual property often requires a workforce of pros. This community could embrace business brokers, actual property attorneys, accountants, property managers, and probably extra, relying on the complexity of the offers. In residential actual property, whereas professionals are nonetheless concerned, the dimensions and complexity of transactions are sometimes much less demanding, and buyers typically take a extra hands-on method.

Regulatory and Zoning Considerations

Commercial properties face a distinct set of regulatory and zoning necessities than residential properties. Investors want to concentrate on native zoning legal guidelines, environmental laws, and potential land use restrictions. Zoning legal guidelines can have an effect on the kind of enterprise actions allowed on the property and any future developments. Such regulatory issues sometimes contain further due diligence when investing in business actual property.

Risks and Rewards

The threat and reward profile of business versus residential actual property can fluctuate drastically. Commercial actual property typically provides larger incomes potential because of its means to generate important money circulation from a number of tenants. However, it additionally carries larger dangers, together with longer emptiness durations when a tenant leaves, larger upfront capital necessities, and better sensitivity to financial cycles. Conversely, residential actual property is usually thought of extra secure however with decrease revenue potential.

Active vs. Passive Investment Strategies

Both business and residential actual property investments may be managed utilizing both energetic or passive methods. However, business properties are likely to lean extra in the direction of passive funding methods, as they typically contain hiring skilled property administration companies. In distinction, residential properties, particularly single-family houses, are extra generally actively managed by the buyers themselves, although property managers can be employed on a smaller scale.

Market Research and Analysis

Research and evaluation for business actual property investments are extra complicated than for residential. It requires a deep dive into market tendencies, financial indicators, and understanding particular business sectors, equivalent to retail, industrial, or workplace area markets. Residential market analysis tends to focus extra closely on native demand, faculty district high quality, neighborhood tendencies, and demographic shifts.

Evaluation of Tenant Quality

Commercial investments typically contain vetting companies and firms, which requires assessing their monetary well being, credit score rankings, and long-term viability. Comparatively, evaluating tenants for residential properties is a extra easy course of involving credit score checks, rental historical past evaluations, and generally private references.

How Can You Navigate Complexity in Commercial Real Estate Investments?

- Cultivate relationships with seasoned business actual property professionals and mentors.

- Become acquainted with key funding efficiency metrics particular to business property.

- Understand the implications of long-term lease agreements and related legalities.

- Invest time in studying about zoning legal guidelines and regulatory points that affect business actual property.

- Assess and put together for the monetary dedication required for business property investments.

- Consider some great benefits of forming a authorized entity, equivalent to an LLC, for possession of business properties.

- Stay knowledgeable about market tendencies and financial components that have an effect on business actual property.

- Develop a threat administration technique tailor-made to the particular challenges of business investments.

“`html

What are the primary variations between business and residential actual property investments?

Commercial actual property investments sometimes contain properties which can be used for enterprise functions, equivalent to workplace buildings, retail areas, warehouses, and industrial complexes. Residential actual property investments, however, are properties used for residing, equivalent to homes, flats, and condos. The fundamental variations lie in lease phrases, financing choices, funding methods, administration necessities, and potential returns on funding.

How do lease phrases between business and residential properties differ?

Lease phrases for business properties are usually longer than these for residential properties, typically ranging from 5 to 10 years, in comparison with 6 to 12 months for residential leases. Commercial leases additionally embrace phrases concerning upkeep tasks, lease will increase, and property enhancements, which may be extra complicated than residential lease agreements.

Is financing for business actual property completely different from residential?

Yes, financing for business actual property typically requires larger down funds, has stricter borrowing standards, and options completely different mortgage buildings in comparison with residential financing. Interest charges could also be larger, and mortgage phrases may be shorter than residential mortgages.

Are there completely different valuation strategies for business versus residential properties?

Commercial actual property values are primarily decided by the revenue they generate, utilizing cap charges and cash-on-cash returns. Residential property values are sometimes assessed based mostly on comparable gross sales of comparable houses within the space, making an allowance for components like location, facilities, and total situation.

Does business actual property present larger returns than residential?

While each kinds of investments have the potential for prime returns, business actual property typically offers larger yields because of longer-term leases and incremental lease will increase structured within the lease agreements. However, these returns may be accompanied by better threat and better preliminary funding prices.

What are the administration necessities for business vs residential properties?

Management of business properties may be extra complicated, requiring data of business leases, property upkeep requirements for companies, and familiarity with business tenants’ operations. Residential property administration is usually less complicated however can contain extra frequent tenant turnover and related prices.

How does the danger profile differ between business and residential actual property?

Commercial actual property may be seen as having the next threat profile because of the reliance on enterprise tenants, susceptibility to financial downturns, and the specialised nature of the properties. Residential actual property is commonly thought of to be decrease threat, given the constant want for housing and extra in depth pool of potential tenants.

Can smaller buyers take part in business actual property investing?

While business actual property investing has historically been the area of bigger buyers because of the important capital required, there are alternatives for smaller buyers to take part by way of syndications, actual property funding trusts (REITs), and crowdfunding platforms.

What are the key differences in investment strategies between commercial and residential real estate?

When conducting a real estate investment comparison analysis, it’s important to note that commercial and residential investment strategies differ significantly. Commercial properties typically offer higher income potential but require larger initial investments and may have longer lease terms. Residential properties, on the other hand, are generally more accessible to individual investors and can provide steady rental income with lower management responsibilities.

What affect do financial circumstances have on business versus residential actual property?

Economic circumstances can have a definite affect on each kinds of actual property, however business property efficiency is intently tied to the well being of the economic system, shopper behaviors, and job markets. Residential actual property may be considerably insulated because of the elementary want for housing, though it’s nonetheless affected by components equivalent to rates of interest and unemployment charges.

Are there tax benefits particular to business or residential actual property investments?

Both business and residential actual property investments supply tax benefits, equivalent to depreciation, mortgage curiosity deductions, and the potential for 1031 exchanges. Commercial properties have distinctive alternatives for price segregation research, which might speed up depreciation and improve tax advantages.

Final Thoughts

Investing in business actual property differs from residential investments in varied points, from lease phrases and financing to valuation strategies and administration necessities. Each sort of funding carries its personal set of dangers and rewards, and the selection between the 2 ought to align with an investor’s monetary objectives, experience, and threat tolerance. Prospective buyers ought to conduct thorough analysis and take into account skilled recommendation when venturing into both market.

Ultimately, whereas business actual property could supply larger return potentials and advantages from economies of scale, the residential market offers a decrease barrier to entry and potential for extra secure money circulation. Both markets play essential roles in a well-diversified funding portfolio, and understanding the important thing variations is crucial for anybody trying to make investments efficiently in actual property.

“`