In a period where conventional financial investments dance to the tunes of worldwide markets, collectibles use a charming option with a concrete touch of fond memories and visual gratitude. Collectibles, varying from classic comics and antique furnishings to unusual coins and action figures, are distinct possessions that obtain their worth from their rarity, condition, and cultural significance. Unlike bonds or stocks, these products bring an intrinsic individual worth to collectors, turning their financial investment into a labor of love. The worth of collectibles can value in time, specifically for products with a minimal supply or those connected to substantial historic occasions, however like all markets, it’s subject to the impulses of customer interest and wider financial elements.

The charming world of collectibles is not almost storing treasures; it’s a nuanced video game of market understanding, timing, and typically, a spray of good fortune. In the following areas, we will look into the crucial elements that make collectibles a possibly rewarding financial investment—such as provenance, rarity, and the effect of worldwide patterns as needed. Moreover, we will check out how shifts in generational interests can affect market price and how technological improvements, like blockchain, are transforming the collectibles market. Stay tuned as we unload these insights to much better comprehend whether threading the needle of collectible financial investments may weave a tapestry of revenue or fond memories in your monetary portfolio.

Key Takeaways

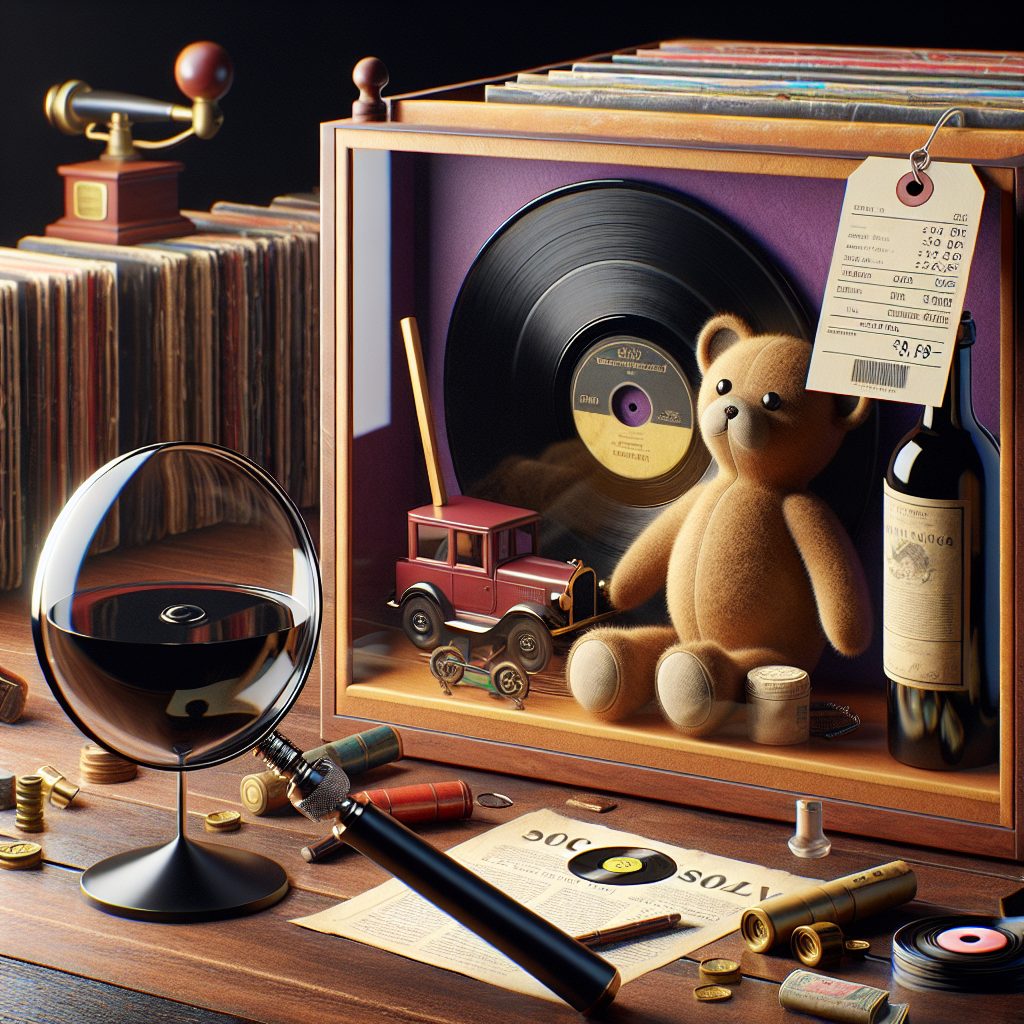

1. Collectibles can possibly yield high returns, outmatching conventional financial investments sometimes. They are concrete possessions that financiers acquire with the hope that they will increase in worth in time. Examples consist of art, stamps, coins, red wine, antique furnishings, and classic cars. Their worth is typically driven by rarity, need, condition, provenance, and cultural or historic significance.

2. The market for collectibles is less regulated and can be more volatile than traditional financial markets. This lack of regulation leads to higher risks, including the possibility of forgery or fraud. Moreover, prices for collectibles can fluctuate wildly based on trends, changing collector interests, and economic conditions.

3. Investing in collectibles requires deep knowledge of the items and the market in which they trade. Successful collectible investing often demands expertise in the specific item or category of items, including understanding nuances that can affect value. For example, knowing the difference between a rare stamp with an imperceptible defect and one in mint condition can mean a significant difference in investment performance.

4. Collectibles do not provide income unless sold for a profit and can have high costs associated with their purchase, maintenance, insurance, and sale. Unlike dividend-bearing stocks or interest-yielding bonds, collectibles require investors to outlay money for proper care, storage, and sometimes authentication or restoration, all of which can erode potential gains.

5. Liquidity can be a major issue with collectibles; they can’t always be sold quickly or easily. The market for a given collectible may be small, making it difficult to find a buyer when one wants to sell. This means that collectibles are often better suited for long-term investment, as investors might need to hold onto them for an extended period before the right selling opportunity arises.

Is Investing in Collectibles a Smart Financial Move?

The Nature of Collectibles as Investments

When evaluating collectibles as an investment, it’s essential to understand their unique characteristics. Unlike stocks or bonds, the value of collectibles is determined by their rarity, condition, and the level of demand among collectors. These items can range from vintage toys and antique furniture to sports memorabilia and artworks. The market for each type of collectible is distinctive and influenced by cultural trends, making the investment potential fluctuate.

Assessing Market Demand

Before investing in collectibles, researching market demand is crucial. The scarcity of a collectible is often a determining factor in its value. Highly sought-after items that are in limited supply tend to appreciate over time. Pop culture trends, economic factors, and societal changes can all impact what is popular and, consequently, what will increase in value. Investors should keep a keen eye on market trends and consider the long-term popularity of the items they wish to invest in.

Condition and Authenticity

For collectibles, the condition is paramount. Items in mint condition, or as close to original as possible, hold the greatest value. It’s also essential for collectibles to be authentic; forgeries or replicas are often worth significantly less. Investors should be prepared to seek professional appraisals and to verify the authenticity of their collectible items before making significant investments.

Risks and Volatility

Like any investment, collecting comes with its share of risks. The value of collectible items can be highly volatile, and bubbles may form in certain markets. A collectible that is highly valuable today could lose its appeal tomorrow. Furthermore, there is no guarantee of liquidity. Selling a collectible, especially if it is a niche item, can be challenging and take time.

Diversification and Portfolio Balance

Investing in collectibles might be a method to diversify an investment portfolio. However, because the collectibles market operates independently of the stock market, it should not be relied upon as a primary investment strategy. A balanced portfolio with a variety of assets can help mitigate overall investment risk.

The Impact of Transaction Costs

Transaction costs can erode the overall profitability of collectible investments. Buyers should consider auction fees, insurance costs, and the potential expenses for storing and preserving their collectibles. Also, when it comes time to sell, marketing costs and seller’s fees can take a significant bite out of the total return on investment.

Tax Considerations

Another important aspect to consider is the tax implications of investing in collectibles. In many jurisdictions, collectibles are taxed differently than traditional investments. Capital gains on collectibles can be taxed at a higher rate compared to other assets. It is advisable to consult with a tax professional to understand the tax obligations involved with buying and selling collectibles.

Investing in Trending Collectibles

Emerging trends can be an opportunity for investors to get in on the ground floor before a collectible increases in value. However, it requires a nuanced understanding of what makes a collectible desirable and an ability to act quickly on market trends. Investors should be cautious and not overly speculative, as not all trends will yield profitable outcomes.

How Can You Strategize Your Collectibles Investment?

Building a strategy for investing in collectibles involves due diligence, a well-thought-out purchase plan, and patience. Networking with other collectors, attending auctions, and staying informed about the collectibles market are essential steps for those serious about turning collectibles into worthwhile investments.

1. Research

Conduct thorough research into the specific collectible markets you are considering, and keep abreast of any relevant news or trends that could affect demand and value.

2. Quality Over Quantity

Focus on acquiring fewer, higher-quality items rather than amassing a large collection of lesser value.

3. Documentation and Provenance

Always secure and maintain documentation of authenticity and provenance as it bolsters the item’s value and desirability.

4. Storage and Preservation

Invest in proper storage facilities and maintenance to preserve the condition of your collectibles, as this directly affects their value.

5. Expert Appraisals

Have your items periodically appraised by experts to ensure you have an accurate understanding of their current market value.

6. Diversification

Consider diversifying within the collectibles market, investing in different types of collectibles to spread risk.

What Are the Guiding Tips for Navigating Collectible Investments?

- Understand the unique risks associated with collectible investments, including market volatility and liquidity concerns.

- Anchor your investment decisions in solid research and remain forward-thinking about future market trends.

- Ensure adequate insurance coverage for high-value collectibles to protect against loss or damage.

- Be mindful of the emotional value that may affect your judgment and strive to maintain objectivity in buying and selling collectibles.

- Collaborate with reputable dealers and auction houses with proven track records to build a network of trusted industry contacts.

What Defines a Collectible as an Investment?

A collectible is considered an investment when it holds the potential to increase in value over time. These items are often rare, sought after, or have some cultural, historic, or aesthetic significance that makes them desirable to collectors and investors alike.

How Do Market Trends Affect Collectible Values?

Market trends play a significant role in determining the value of collectibles. Pop culture, economic conditions, and collector demand can all influence the price and popularity of collectible items, causing fluctuations in their investment potential.

What Risks Are Involved in Investing in Collectibles?

Investing in collectibles comes with risks, such as market volatility, the potential for counterfeit items, changes in consumer tastes, and difficulties in assessing true value. Unlike conventional investments, collectibles do not generate income and their value can be more subjective.

Can Collectibles Be Part of a Diversified Investment Portfolio?

Yes, collectibles can be a part of a diversified investment portfolio. They offer an alternative asset class that can potentially hedge against inflation and provide balance, as their value doesn’t always move in correlation with stocks and bonds.

What Is the Impact of Condition on Collectible Value?

The condition of a collectible is crucial to its value, with items in mint or pristine condition usually being the most valuable. Damage, wear, or restoration can significantly decrease an item’s worth in the collector’s market.

How Important Is Authenticity and Provenance in Collectible Investing?

Authenticity and provenance are vital in collectible investing. Verifiable authenticity ensures the item is not a counterfeit, while a well-documented provenance can trace the item’s history and ownership, adding to its value and credibility as an investment.

Are Certain Types of Collectibles Better Investments Than Others?

Some collectibles have a better track record of appreciating in value, such as classic cars, rare stamps, coins, fine art, and vintage watches. However, this is not guaranteed and individual items can outperform or underperform depending on various factors.

How Can Investors Liquidate Collectibles?

Liquidating collectibles can be done through auctions, private sales, dealers, or specialty websites. However, it might take time to find the right buyer willing to pay the desired price, making collectibles less liquid than traditional investments.

What Tax Implications Are Associated with Collectibles?

Collectibles may be subject to different tax rates than other investments when sold at a profit. In many jurisdictions, collectibles can be taxed at a higher capital gains rate compared to stocks or bonds, so it’s important to understand the tax implications before investing.

How Should an Investor Start Collecting as an Investment?

An investor should start by researching the market thoroughly, understanding the risks, and deciding the niche of collectibles that aligns with their interest and budget. Consulting with experts in the field and starting small with manageable investments is often a prudent approach.

Final Thoughts

Investing in collectibles can be an exciting and rewarding venture, but it’s not without its nuances and complexities. As with any investment, it’s imperative to do thorough research, understand the risks, and consider how collectibles fit within your overall monetary strategy. While they can offer diversification and the joy of owning unique, tangible assets, it’s important to remember that their values are subject to change and can be more difficult to liquidate than more traditional investments.

In conclusion, collectibles may be a good investment for those who are passionate about the products and willing to invest the time to understand the marketplace. However, careful consideration should be given to the amount of capital allocated to such investments, the liquidity needs of the investor, and the prospective for long holding periods. If done wisely, gathering can be both personally pleasing and economically helpful.