Navigating the world of investments can often feel like a trek through uncharted territory. But fear not, as we’re about to shed some light on the lay of the land. In particular, we’ll be comparing index funds with their cousins, ETFs and mutual funds. You’re in for a treat if you’ve ever wondered about the differences or which […]

How to Interpret Stock Market Indices?

Stock market indices are barometers of monetary health and financial vitality, typically functioning as a proxy for financier belief and market patterns. Comprised of a choice of stocks representing a specific section of the marketplace, these indices supply a summary of market motions and a standard versus which specific stock efficiencies can be compared. For circumstances, the S&P […]

What Is Tmt Investment Banking

In the high-paced world of financing, TMT investment banking sticks out as the specialized craft of directing innovation, media, and telecommunication business through the turbulent waters of mergers, acquisitions, and capital raising. These lenders are the designers behind the monetary methods that move ingenious concepts into business successes, browsing a landscape that is as abundant in chance as […]

Going Global: ETFs vs Mutual Funds for International Investing

Venturing into the world of international investing can be as thrilling as it is bewildering. Choosing the right vehicle to navigate global markets is crucial, and you’re likely weighing up ETFs (Exchange-Traded Funds) against mutual funds. Both have their champions and critics, but what’s the real score? In this piece, we’ll delve into the nuts and bolts of […]

What Are Catch-Up Contributions and How Do They Work?

As we approach the golden years of retirement, numerous people understand that their savings may not be as robust as they had actually hoped, triggering the requirement for a sped up cost savings method. Enter catch-up contributions, a monetary arrangement that enables people aged 50 and over to make extra contributions to their pension beyond the basic limitations. […]

What Is the Significance of a Stock’s P/E Ratio?

When it pertains to examining the worth and capacity of a stock, one of the most telling indications is its Price-to-Earnings (P/E) Ratio. This effective metric is born from a basic department: the market price per share divided by the revenues per share (EPS). In essence, the P/E ratio supplies a yardstick for financiers to assess whether a […]

Sector Investing: Choosing Between ETFs and Mutual Funds

Navigating the labyrinth of investment options can be daunting. When you’re zeroing in on sector investing, the choice often boils down to two contenders: ETFs or mutual funds. Both vehicles offer a dive into targeted market segments, but picking the right one could make a world of difference for your portfolio. This article unpacks the nuts and bolts […]

How Do Target-Date Funds Work for Retirement Planning?

As a financial investment technique customized for retirement, target-date funds provide a unique amalgamation of simpleness and advanced property allowance. The core concept of a target-date fund is anchored in its slide course—the fund’s property allowance technique—which is developed to develop instantly as the financier inches better to a defined retirement year. This predefined retirement horizon offers the […]

How Can I Use Technical Analysis in Stock Investing?

Technical analysis is an approach that financiers and traders use to forecast the future direction of stock prices through the study of past market data, primarily price and volume. Unlike fundamental analysis, which delves into financial statements and economic indicators, technical analysis focuses on identifying patterns and trends in price charts to understand market sentiment and predict what […]

How Does Insurance Fit into an Investment Strategy?

Insurance, typically viewed exclusively as a safeguard for unexpected disasters, can really function as a critical part in a well-rounded investment method. Fundamentally, insurance offers monetary security versus possible losses and, when utilized tactically, can improve one’s monetary preparation landscape. This double nature permits it to stand apart to name a few monetary instruments. Investing, on the other […]

ETFs vs Mutual Funds in Retirement Planning

When it comes to securing your golden years, choosing the right investment vehicle is crucial. You’ve probably heard of ETFs (Exchange-Traded Funds) and mutual funds, but knowing which one can bolster your retirement plan is a head-scratcher for many. In this article, we’ll dive into the nitty-gritty of ETFs versus mutual funds, unpacking their features, costs, and potential […]

Who Bears All The Investment Risk In A Fixed Annuity

A fixed annuity is a kind of insurance coverage agreement which assures to pay the holder a surefire earnings at routine periods, usually after retirement. This type of investment lorry is especially appealing to those looking for stability and predictability in their monetary preparation. The special appeal of a fixed annuity depends on its capability to use a […]

How Do Capital Gains Tax Rates Vary by State?

Capital gains tax is a levy on the revenue that a specific makes from the sale of properties like stocks, bonds, or property, and it’s a considerable element of tax codes throughout the United States. However, not all states deal with capital gains similarly, leading to a complicated tapestry of differing rates. While the federal government sets standard […]

What Is the Difference Between Corporate and Municipal Bonds?

Bonds belong to loans made by financiers to companies, however not all bonds are produced equivalent. The landscape of the bond market varies, with corporate and municipal bonds representing 2 considerable classifications that deal with various kinds of financiers. Corporate bonds are provided by business looking for capital to broaden their service operations, purchase brand-new jobs, or re-finance […]

Breaking Down Fees: ETFs vs Mutual Funds

Investing can be a maze of choices, especially when it comes to the costs that nibble away at your returns. Whether you’re leaning towards Exchange-Traded Funds (ETFs) or eyeing Mutual Funds, understanding the fee structure is key. In this insightful piece, we’ll break down the expenses associated with each option, helping you make an informed decision without getting […]

Does Nike Invest In Private Prisons

In current years, the crossway of big corporations and the criminal justice system has actually triggered questionable conversations, especially concentrating on the participation of private jails. These organizations run on a for-profit basis, implying they are owned by private entities that are contracted by the federal government to jail people. The factor such a design amasses attention is […]

Who Owns Lakoma Island Investments Llc

In the complex tapestry of property financial investment, LLCs (Limited Liability Companies) stand apart as a popular structure for home ownership due to their capability to restrict individual liability and deal tax benefits. One such entity that has actually gathered attention is Lakoma Island Investments LLC—a business shrouded in business veils, typically making it challenging to determine the […]

Passive vs Active: ETFs and Mutual Funds Compared

Navigating the maze of investment options can be a daunting task, with ETFs and mutual funds often at the center of the debate. Deciding between passive or active management is a critical choice that could steer your portfolio’s performance. In this article, we’ll dissect the contrasts between these two strategies, unpacking how they operate and their potential impact […]

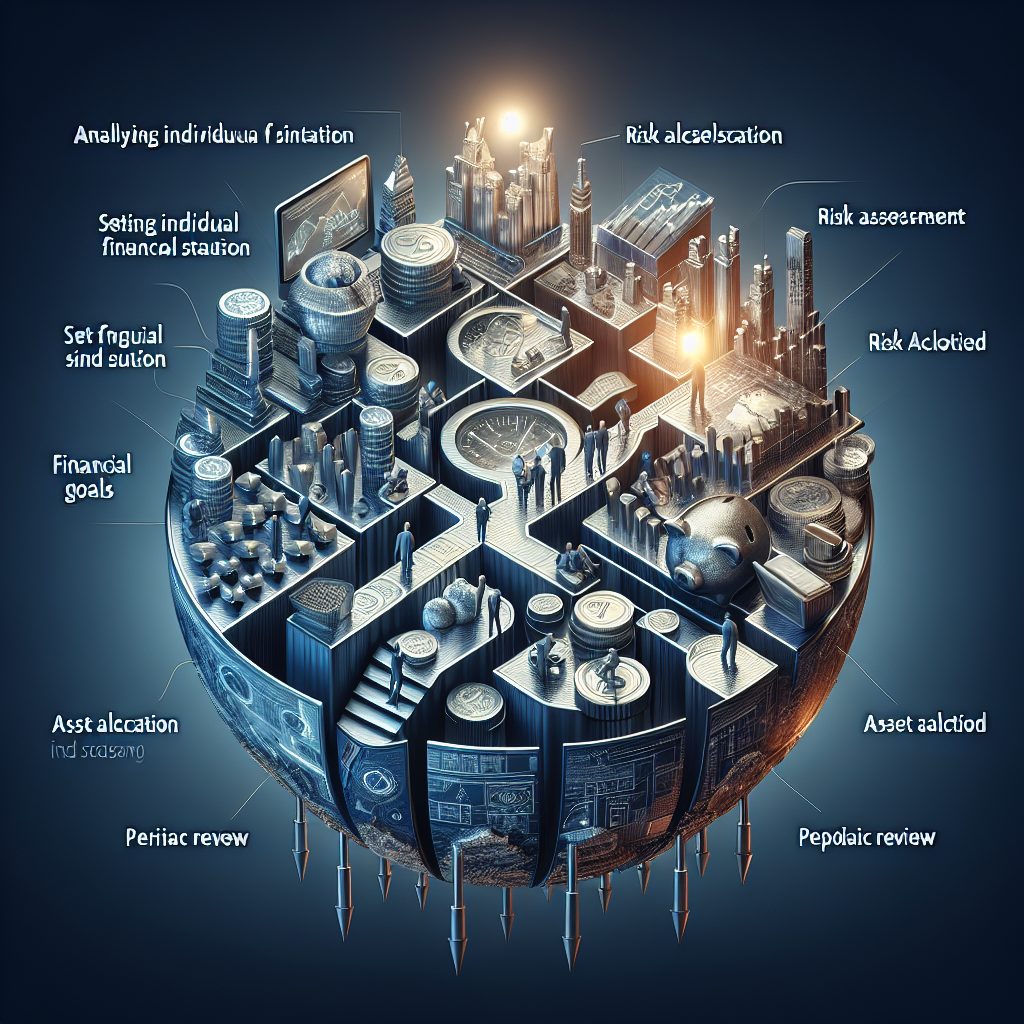

Why Should You Make A Personal Investment Plan Brainly

Personal investment preparation is a tactical plan that guides people in transporting their funds into different investment cars with the goal of attaining particular life objectives. Whether it be conserving for retirement, collecting capital for a service endeavor, or making sure instructional funds for kids, a well-crafted investment plan can act as the compass guiding your monetary choices […]

Performance Showdown: ETFs vs Mutual Funds

When it comes to growing your wealth, picking the right investment vehicle is crucial. Are you torn between ETFs (Exchange-Traded Funds) and mutual funds? You’re not alone. Both have their die-hard advocates and compelling benefits, but which one takes the lead in performance? In this showdown, we’ll dive deep into the nitty-gritty of ETFs versus mutual funds, helping […]