Navigating the world of financial investments belongs to setting sail in a large, unforeseeable ocean. At its core, investing is the act of assigning funds into different monetary cars with the anticipation that, gradually, these allowances will grow in worth. For beginners, the seas of stock exchange, shared funds, and bonds can appear challenging, laden with monetary lingo […]

What Are the Key Differences Between Stocks and Bonds?

When diving into the world of financial investments, one is most likely to come across 2 main cars that stand as pillars of the monetary markets: stocks and bonds. Stocks, likewise called equities, represent an ownership stake in a business, consequently supplying investors with a claim to a part of the business’s earnings and properties. On the other […]

Maximizing Returns with Bond Laddering Strategies

In the world of investing, smart strategies make all the difference. Bond laddering is one such approach, offering a blend of income stability and strategic reinvestment. It’s like climbing a staircase where each step is a carefully chosen bond maturing at a different time. You’re about to dive into the mechanics of this method and how it can […]

What Is A Portfolio Investment Entity

A Portfolio Investment Entity, frequently understood by its acronym PIE, is a kind of investment car unique to New Zealand, customized to incentivize cost savings and investment amongst citizens. Under the unique tax program governing PIEs, financiers can take advantage of decreased tax rates on their investment earnings, with rates subject to their proposed financier rate (PIR), which […]

What is an ETF and how does it differ from a mutual fund?

An ETF, or Exchange-traded Fund, is a kind of mutual fund that tracks an index, product, bonds, or a basket of properties like an index fund, however trades like a stock on an exchange. ETFs experience rate modifications throughout the day as they are purchased and offered, providing financiers the important versatility of intra-day trading. Unlike standard mutual […]

Corporate vs Government Bonds: Choosing Wisely

Navigating the world of investments can be a tricky affair, especially when deciding between corporate and government bonds. Investors often find themselves at a crossroads, weighing the relative safety against potential returns. In this insightful exploration, we’ll dive into the nuances of both options. You’ll learn how to make an informed choice that aligns with your financial goals […]

How do I choose a mutual fund or ETF?

Embarking on the financial investment journey, one is typically confronted with a fork in the roadway: the option in between a mutual fund or an Exchange-Traded Fund (ETF). At its core, a mutual fund is a swimming pool of cash gathered from lots of financiers to purchase a portfolio of stocks, bonds, or other securities, handled by a […]

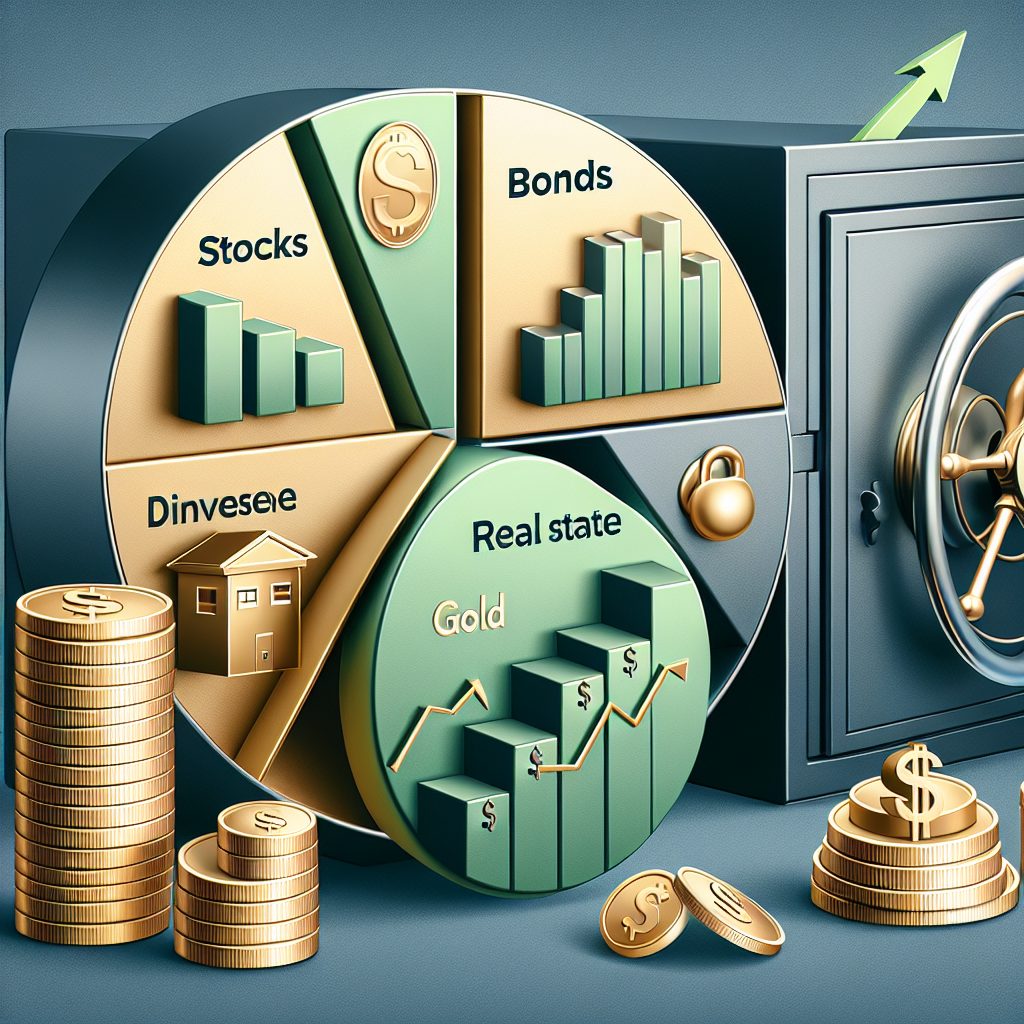

What are the benefits of diversification in an investment portfolio?

In the world of investing, diversification belongs to not putting all your eggs in one basket; it’s the technique of dispersing financial investments throughout different monetary instruments, markets, and other classifications to decrease the effect of any single property’s efficiency on the total portfolio. This threat management method acknowledges that various possessions frequently carry out in a different […]

Navigating the Risks of Bond Investing

Steering through the intricacies of bond investing can feel like charting a course across a stormy sea. Risks loom large, from interest rate fluctuations to credit events that could erode your hard-earned cash. Yet, bonds remain a cornerstone of savvy investment strategies, offering a blend of stability and income potential in an often volatile financial landscape. In this […]

How do risk and return work in investing?

In the world of investing, the ideas of risk and return are forever linked, showing the vital compromise at the core of every monetary choice. Risk, in its easiest kind, is the likelihood of experiencing loss or less-than-expected returns on a financial investment. Conversely, return is the earnings produced from a financial investment, whether it be through dividends, […]

Decoding Bond Yields: What Investors Should Know

Navigating the world of finance often feels like trying to read a map in an unfamiliar language. For investors, decoding bond yields is crucial, yet it can be as perplexing as a labyrinth. This article peels back the layers of complexity surrounding bond yields, offering clear insights into what they signify and how they affect your investments. You’ll […]

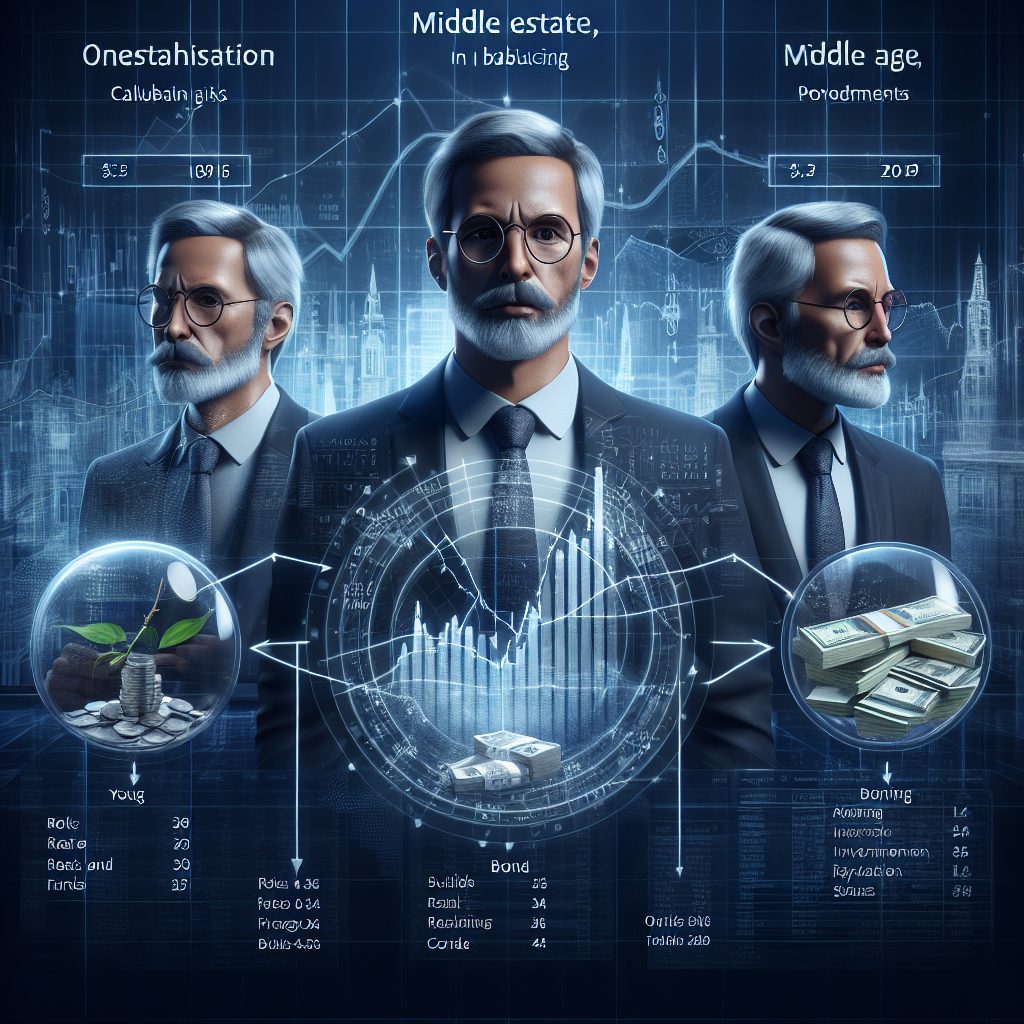

How should my investment strategy change as I get older?

Investment strategy is the plan for structure and handling a monetary portfolio that can fulfill your short-term and long-lasting goals. As the hands of time move inexorably forward, our financial objectives shift, with age not just bringing wisdom, but also changing risk tolerance and time horizons. In our youth, a bold stance in high-risk, high-reward ventures may seem […]

What are stock indices and why do they matter?

Stock indices are barometers of monetary health for markets and economies, tracking the efficiency of a basket of stocks to determine the marketplace’s total instructions. At their core, these indices embody the cumulative motions of choose stocks, which represent different sectors and market sections. Imagine them as a control panel, providing a picture of market characteristics at any […]

Exploring the Different Types of Bonds

Diving into the world of financial investments, bonds stand out as a fundamental component. They’re not just for the Wall Street gurus; understanding bonds is crucial for anyone looking to solidify their portfolio. This article peels back the layers of this investment vehicle, offering a clear view of the various bond types available. From government-issued treasures to high-yield […]

How do bear and bull markets work?

In the ever-evolving tapestry of the monetary markets, 2 animals have actually concerned signify the really heart beat of financial belief: the bear and the bull. Named after the approaches by which each animal assaults its enemies, these markets show the cumulative outlook of financiers around the world. A bull market is represented by increasing stock rates, frequently […]

Bond Investing 101: A Comprehensive Guide

Diving into the world of bond investing can be as interesting as it is rewarding. It’s a financial journey that offers a blend of stability and potential income, making it a go-to strategy for many savvy investors. This guide serves as your compass, navigating through the fundamentals of bond investments. From understanding different types of bonds to grasping […]

How do government bonds differ from corporate bonds?

When financiers aim to diversify their portfolios and include a procedure of stability, bonds typically play a main function. Serving as a loan from the financier to the provider, bonds enable entities to raise capital with the pledge of paying back the principal plus interest over an established duration. However, it’s not simply the roi that differs in […]

What should beginners know about investing in rental properties?

Investing in rental homes can be a profitable venture that not just offers a consistent stream of passive earnings however likewise provides the capacity for residential or commercial property worth gratitude. This type of property financial investment includes acquiring residential or commercial property with the intent of letting it to occupants, which produces rental earnings. However, for beginners, […]

What is the difference between active and passive investing?

In the huge ocean of financial investment techniques, browsing the distinctions between active and passive investing can feel comparable to identifying between 2 powerful sea animals — while both come from the exact same waters, they move through it in extremely special methods. Active investing is the systematic pursuit of pounding the market’s efficiency through constant purchasing and […]

Navigating Interest Rate Risk in Your Investment Portfolio

In the dance of digits where interest rates lead, savvy investors must move with grace and strategy. Facing the ebb and flow of fluctuating rates can be like navigating a maze blindfolded. This article throws light on mastering the art of mitigating interest rate risk in your investment portfolio. As you read on, you’ll learn to sidestep pitfalls […]